Asset managers can use leverage to enhance returns. Outside hedge funds, such leverage is modest as share of assets under management. However, considering the huge volume of assets, changes in buy-side leverage still have a significant impact on financial conditions, particularly in emerging markets. Also, both theory and empirical evidence suggest that leverage is pro-cyclical.

资产经理可以利用杠杆来提高收益。在外部对冲基金中,这种杠杆作用仅相当于所管理资产的份额。但是,考虑到庞大的资产规模,买方杠杆的变化仍然会对财务状况产生重大影响,尤其是在新兴市场中。同样,理论和经验证据都表明,杠杆是顺周期的。

Avalos. Fernando, Ramon Moreno and Tania Romero, “Leverage on the buy side”, BIS Working Papers, No 517http://www.bis.org/publ/work517.htm

The below are excerpts from the paper. Headings, links and cursive text have been added.

The 1×1 of leverage on the buy side

买方市场(对冲基金/共有基金/主权基金)等的1比1金融杠杆

“Leverage used by an investment fund can [use]…funding leverage, which involves outright borrowing, and instrument leverage [also called synthetic leverage], implemented through derivative contracts that amplify the sensitivity of portfolio returns to the underlying asset risk factors.”

“投资基金使用的杠杆可以使用涉及直接借款的融资杠杆,以及通过衍生品合同实施的工具杠杆[也称为合成杠杆],从而放大了投资组合收益对潜在资产风险因素的敏感性。”

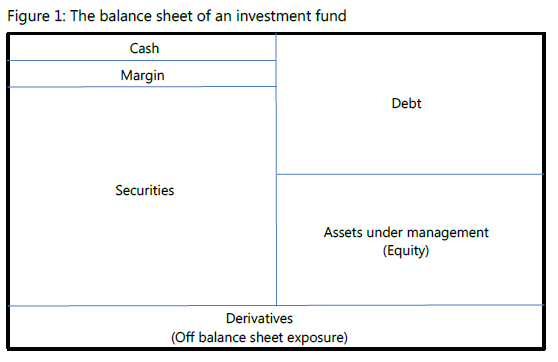

“[The figure below] represents the typical balance sheet of a fund. On the source side we have its capital structure, comprising debt and the assets under management (AUM). Debt corresponds to short cash positions (or short-term borrowing) and short security positions. AUM is the difference between the fund´s asset and liability positions, and represent the total claim individual investors have on the investing pool. On the asset side we have cash held in long positions, securities held in long positions and margin, i.e. collateral typically requested by lenders in order to extend credit. Derivatives can be assets or liabilities depending on whether they are held long or short, but they are in effect off-balance sheet contingent claims. The relative size of all these different parts will depend on the type of fund and portfolio strategy. For instance, hedge funds are likely to have the largest borrowing relative to AUM, whereas passive mutual funds aimed at retail investors are likely to have minimal debt and relatively small long cash positions. Distressed debt funds use little or no leverage and keep a large share of their portfolio in cash.”

下图表格代表基金的典型资产负债表。在来源方面,我们拥有其资本结构,包括债务和管理资产(AUM)。债务对应于空头现金头寸(或短期借款)和空头担保头寸。AUM是基金资产和负债头寸之间的差额,代表个人投资者对投资池的总债权。在资产方面,我们拥有多头头寸持有的现金,多头头寸持有的证券和保证金,即贷方通常要求提供抵押品以扩展信贷。衍生工具可以是资产或负债,具体取决于持有的是多头还是空头,但实际上它们是表外或有债权。所有这些不同部分的相对规模将取决于基金类型和投资组合策略。例如,对冲基金相对于资产管理规模可能有最大的借贷,而针对散户投资者的被动型共同基金则可能负债最少且长期现金头寸相对较小。陷入困境的债务基金几乎没有使用杠杆,甚至没有杠杆,并且将大量投资组合保留为现金。

“Leverage is usually defined as…gross leverage, net leverage and long leverage. Gross leverage adds the short and long positions in securities, divided by AUM. This measure is very conservative, since it treats the short and long positions as independent sources of revenue, while in many cases they are part of a single bet and tend to hedge each other. As a result, gross leverage tends to overstate economic exposure. Net leverage is the difference between long and short positions in risky assets, which corrects the bias of gross leverage but does not account for the risk created by long or short positions that are effectively independent bets. Thus this measure is likely to understate risk.

杠杆通常被定义为总杠杆,净杠杆和多头杠杆。总杠杆(Gross leverage)增加了证券的空头和多头头寸,除以资产管理规模的水平(AUM)。这项措施非常保守,因为它将空头和多头头寸视为独立的收入来源,而在许多情况下,它们是同一笔赌注的一部分,往往会相互对冲。结果,总杠杆水平往往会放大经济风险。净杠杆率是指风险资产的多头和空头头寸之间的差额,该差额纠正了总杠杆率的偏差,但没有考虑由有效或独立投注的多头头寸或空头头寸产生的风险。 因此,该措施可能会低估金融市场风险。

Finally, long leverage is the ratio of long security positions to AUM. This is probably the easiest and more common way to think about leverage. It is readily available for US-based institutions, because the SEC requires this information from any fund managing over USD 100 million. All the above measures of leverage also ignore the exposure from off-balance sheet derivative positions.”

最后,多头杠杆是多头安全头寸与AUM的比率。这可能是考虑杠杆作用的最简单,最常见的方法。美国证券交易委员会要求任何管理超过1亿美元资金的基金提供此信息,因为美国证券交易委员会要求这些信息。上述所有杠杆措施也忽略了表外衍生工具头寸带来的风险。

“Leveraged portfolios enhance the gains of successful investment strategies, at the cost of magnifying the losses when financial conditions sour. Consequently they may be subject to severe allocation reversals and fire sales, which could sharpen the return volatility of the assets included in such portfolios.”

Different funds have different leverage

不同的基金有不同的杠杆

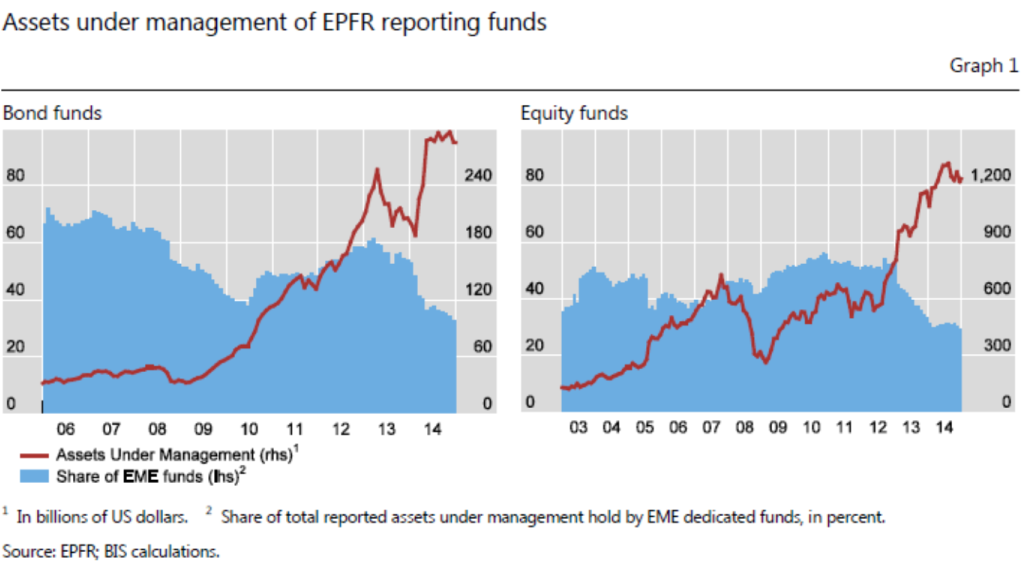

“Since [the great financial crisis]…asset managers have quickly increased their footprint in global financing, helped by the sharp retrenchment of banks nursing their balance sheets back to health…Since 2009, bond financing has become prevalent in global international financing, with an expansion exceeding USD4 trillion, whereas cross border bank lending has contracted by almost USD2 trillion…Unconventional monetary policies in advanced economies have squeezed returns while reducing borrowing costs, which in principle creates an incentive for asset managers to use more leverage.”

“自08年金融危机以来...资产管理人迅速增加了其在全球融资中的足迹,这得益于银行大幅裁员,使资产负债表恢复健康...自2009年以来,债券融资已在全球国际融资中盛行, 扩张规模超过4万亿美元,而跨境银行贷款却缩水了近2万亿美元……发达经济体的非常规货币政策在降低回报成本的同时降低了借贷成本,从原则上讲激励了资产管理公司使用更多的杠杆。”

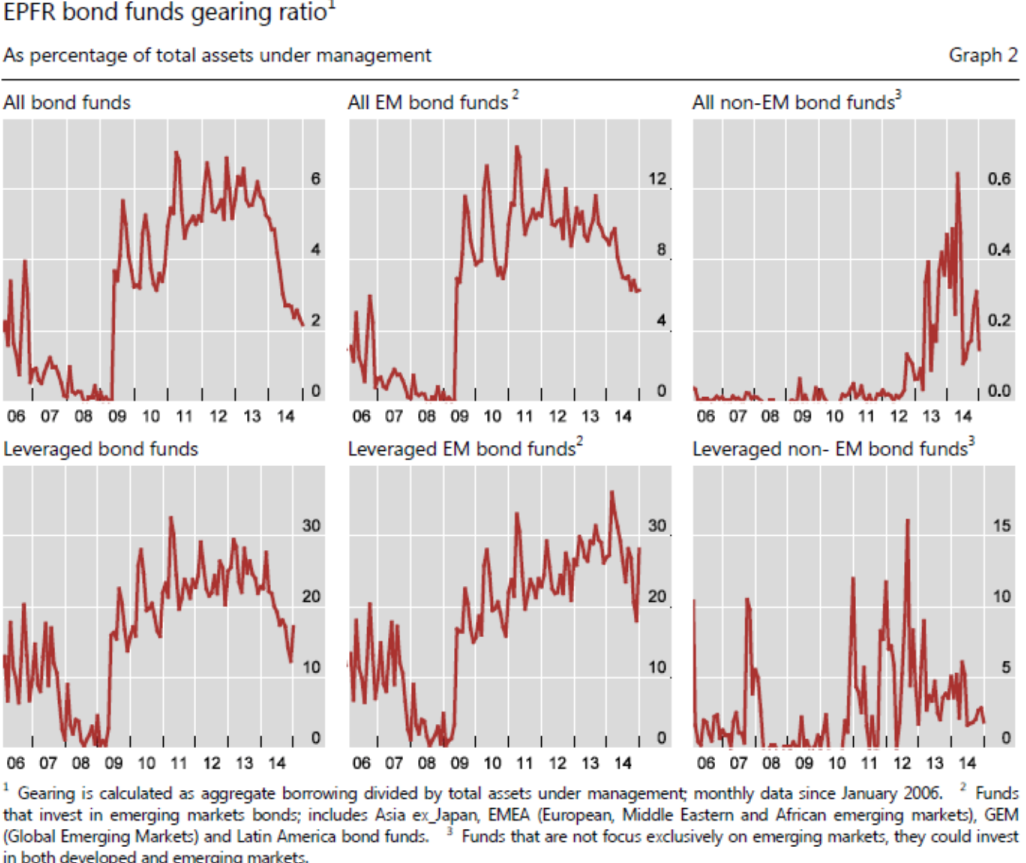

“Using information provided by a market data vendor…[leverage] seems to vary considerably depending on the type of fund… In most of the analysis…we focus on funding leverage by using a measure closely related to long leverage… the ratio of long security positions in excess of AUM divided by AUM….Equity fund portfolios seem to be minimally leveraged, while fixed income funds tend to resort abundantly to borrowed money. Funds dedicated to global markets or advanced economies had little debt in their capital structure, whereas debt in leveraged EM fixed income funds was close to 30 percent of AUM towards the end of our sample period.“

“使用由市场数据供应商提供的信息,采用的金融杠杆取决于基金或是策略本身的类型。因此在大多数分析中,我们通过使用与长期杠杆密切相关的措施来关注资金杠杆以及长期持有头寸的比率(超过总资产规模AUM的头寸除以AUM)。股票基金投资组合的杠杆作用似乎很小,而固定收益基金则倾向于大量借入资金。面向全球市场或发达经济体的基金的资本结构几乎没有债务,而在我们的样本期结束时,杠杆型新兴市场固定收益基金的债务接近AUM的30%。”

“We found that leverage on the buy side is not negligible [for emerging markets]. The number of funds using leverage is relatively small in our sample, but their size is about three times that of their unleveraged peers. They control more than 30 percent of AUM in their sector [at the end of 2014] down from 50 percent around 2010, making them quite significant players in their target markets…Only four of the 87 funds in our database report themselves as ‘hedge funds,’ all belonging to the same parent company.”

“我们发现,对于新兴市场而言,买方的杠杆作用微不足道。在我们的样本中,使用杠杆的基金数量相对较少,但其规模约为未杠杆杠杆的同类基金的三倍。他们控制着自己部门(截至2014年底)超过30%的资产管理规模,而2010年约为50%,这使其成为目标市场的重要参与者。我们数据库中的87只基金中只有四只称自己为“对冲基金” ,都属于同一母公司。”

Determinants of leverage on the buy side

买方杠杆的决定因素

“In line with theory, we find that asset managers increase leverage when expected returns increase, and tend to reduce it when market risk perception (or aversion) increases, or when funding costs or funding risks increase. Leverage is also pro-cyclical, in the sense that fund capital gains spur further increases of borrowing.”

“与理论相符,我们发现资产经理会在预期收益增加时增加杠杆,而在市场风险认知(或厌恶情绪)增加或融资成本或融资风险增加时倾向于降低杠杆。 从资金资本收益刺激借贷进一步增加的意义上讲,杠杆作用也是顺周期的。”

Other academic work supports this pro-cyclicality:

- “Acharya and Viswanathan (2011) and Stein (2009) focus on borrowing costs as the main drivers of leverage, finding through different mechanisms that good times tend to increase leverage substantially. Price shocks during those times are particularly damaging because they force a larger extent of deleveraging.”

- “Ang et al (2011) use a richer database than ours to address empirically a similar question on the determinants of the leverage decision of asset managers… They find that…past returns are not significant, whereas market risk at either the fund or macro levels can be relevant, and macro measures of borrowing costs are usually inversely related to leverage.”

- “Wang and Wang (2010) model the problem of the fee-maximising, risk-neutral investment manager…Consistent with some anecdotal evidence, asset managers have little incentive to sell assets and reduce leverage unless forced to, once the risky asset price has fallen. However, optimal leverage tends to decrease quickly with higher transaction costs and underlying asset price volatility, whereas it will increase with expected returns.”

其他学术工作也支持这种周期性:1. Acharya和Viswanathan(2011)和Stein(2009)将借款成本作为杠杆的主要驱动力,通过不同的机制发现,好时机往往会大大提高杠杆率。在那段时期,价格冲击尤其具有破坏性,因为它们迫使更大范围的去杠杆化。”2. Ang等人(2011)使用比我们更丰富的数据库,以经验方式解决了资产管理者杠杆决策决定因素的类似问题。他们发现过去的收益并不重要,而基金或宏观层面的市场风险却很大。可能相关,而借贷成本的宏观指标通常与杠杆成反比。”3. Wang and Wang(2010)建模了费用最大化,风险中性的投资经理的问题。根据一些轶事证据,除非风险资产价格下跌,否则除非被迫,资产经理几乎没有动力出售资产和降低杠杆率。但是,随着交易成本和潜在资产价格波动的增加,最佳杠杆往往会迅速下降,而随着预期收益的增加,策略可用的最佳杠杆会增加。”

“The tightening of capital controls on inflows in emerging economies seems to be associated with leverage increases, which might be explained by reluctance on the part of portfolio managers to give up a profitable position because of returns-unfriendly regulation. Instead, they would choose to increase leverage in order to preserve higher expected returns, even at the cost of assuming more risk… In this way, ‘capital flow management’ actions taken by large emerging economies, which tend to command large portfolio weights, might be causing a ‘policy spillover’ towards other emerging economies that are commonly represented in the portfolios of global asset managers.”

“对新兴经济体流入的资本管制的收紧似乎与对冲基金行业开始增加杠杆这件事有关,这可以用投资组合经理不愿因为对于基金回报率来说更加严格以及不友好的金融监管而放弃获利头寸来解释。

相反,他们会选择提高杠杆率以保持更高的预期收益,即使以承担更多风险为代价。通过这种方式,大型新兴经济体采取的“资本流管理”行动可能会占据较大的投资组合权重,对其他通常在全球资产管理公司投资组合中体现的新兴经济体造成“政策溢出效果”。”

未经允许不得转载:tiger trade » 【资产管理】杠杆在资产管理中的应用| Leverage in asset management

tiger trade

tiger trade