Will Rising Interest Rates Push Gold Higher?

利率上升会推高黄金价格吗?

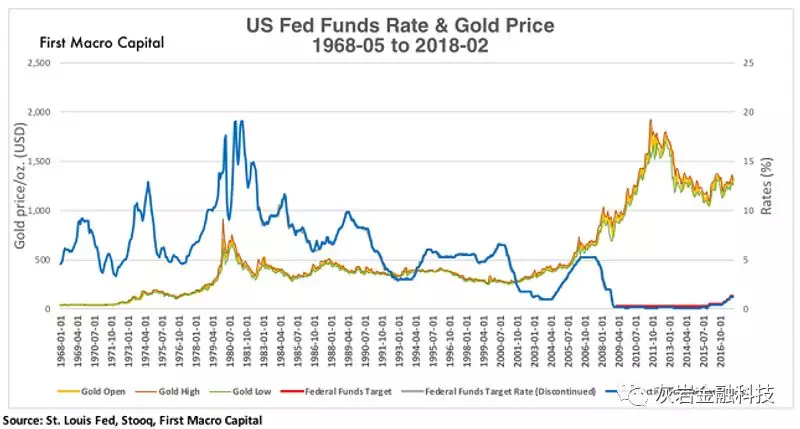

There has been an incredible amount of chatter as to how many times the Federal Reserve is going to raise rates in 2018, and the speed at which it will raise them by. For gold investors, the old question lingers, “What will rising interest rates mean for the price of gold?”

关于美联储在2018年加息的次数,以及它将提高它们的速度,已经出现了令人难以置信的喋喋不休。对于黄金投资者来说,旧问题依然存在,“利率上升对黄金价格意味着什么?”

The simple viewpoint has been that rising rates are bad for gold because gold is not an interest-bearing asset. Why would you own gold if interest rates are rising and gold doesn’t pay you anything? There are typically two sides to the debate on the impact of gold from the change in interest rates. There are those who see rising interest rates as good for gold, and there are those that see rising interest rates as harmful to the price of gold. But who is right? Which side is correct? Could they both be wrong? Or both be right?

一个简单的观点是,上涨利率对黄金不利,因为黄金不是有息资产。如果利率上升而黄金不支付任何费用,你为什么要拥有黄金?关于黄金对利率变化的影响的争论通常有两个方面。有些人认为利率上升对黄金有利,有些人认为利率上升对黄金价格有害。但谁是对的?哪一方是正确的?他们俩都错了吗?或者两者都对吗?

What Happened Before Gold Window Closed from the Nixon Shock?

在Nixon Shock(尼克斯冲击)关闭黄金窗口之前发生了什么?

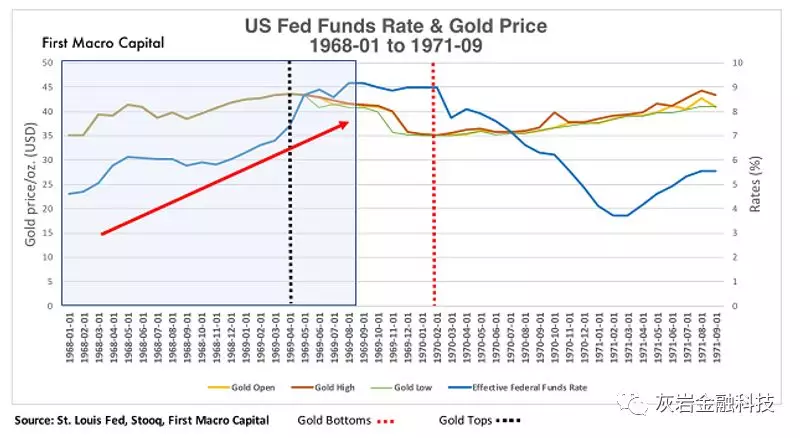

During the three-year period from 1968 to 1971, we witnessed the fed funds rate double from 4.6% to a high of 9.19% in 1969, before falling back down to 3.71% in March 1971. During this time, the gold price went from $35.20/oz. to a high of $43.60/oz. in 1969, three months before the fed funds rate peaked. Gold appreciated 23.2%, nothing spectacular, before falling back to $35.1/oz. in March 1970, a year before the fed funds rate bottomed. We can say that during this time period the trend for both gold and interest rates rose together. The trend was less consistent on the way down and with the recovery thereafter.

在1968年至1971年的三年期间,我们目睹了1969年联邦基金利率从4.6%翻了一番,达到9.19%的高位,然后在1971年3月回落至3.71%。在此期间,黄金价格从$35.20/盎司。至43.60美元/盎司的高点。1969年,联邦基金利率达到顶峰前三个月。黄金升值23.2%,没什么了不起的,之后回落至35.1美元/盎司。1970年3月,联邦基金利率触底前一年。我们可以说,在这段时间内,黄金和利率的趋势一起上升。这种趋势在下行和随后的复苏方面不那么一致。

What Happened to Gold & Interest Rates During the 1970’s?

在1970年代期间,黄金和利率发生了什么?

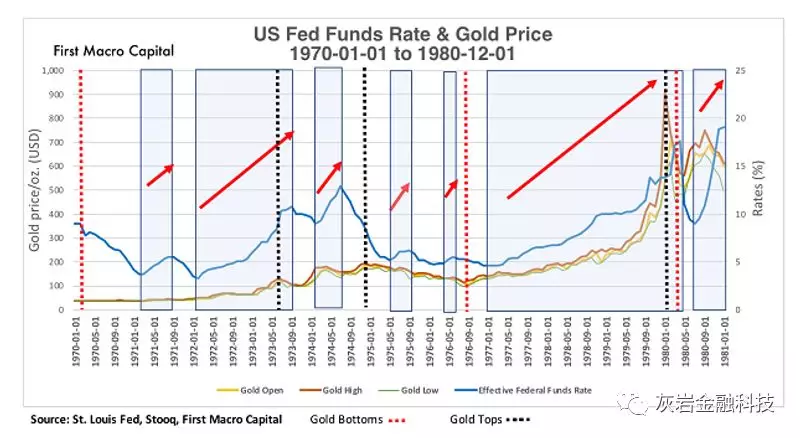

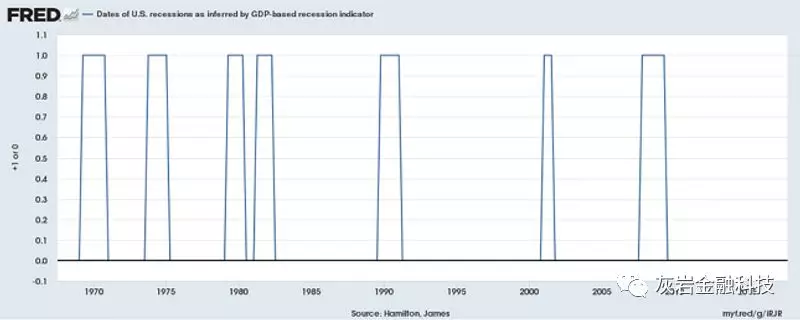

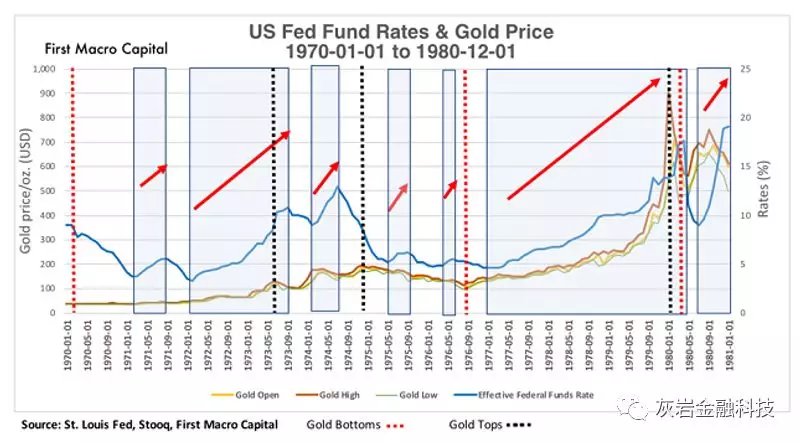

We had seven periods during the 1970’s where the US Fed Fund rates rose for consecutive months before falling for multiple months. The 1970’s started while in a recession, had a recession halfway through and ended with a recession. There were two oil crises in 1973 and 1979, and it was a period of higher inflation. It was a volatile time.

我们在1970年代有七个时期,美国联邦基金利率连续几个月上涨,然后连续几个月下跌。1970年代开始时经济衰退,经济衰退中途,经济衰退结束。1973年和1979年发生了两次石油危机,这是一个通货膨胀率较高的时期。这是一个动荡的时期。

Gold after the Nixon Shock

尼克松冲击之后的黄金价格

Gold bottomed about a year prior the fed funds rate did in February 1970 at $35.20/oz. After Nixon closed the gold window in August 1970, gold went to $195.5/oz. in December 1974. The fed funds rate peaked five months earlier in July 1974 at 12.92%. Many investors use the period after the Nixon closed the gold window (August 1970), as more of a true market gold price. This is because free-market forces were now allowed to decide what the US dollar and gold were worth against one another. Over the next twenty months, gold went down from the December 1974 high, to hit a low of $100/oz. in August 1976.

在1970年2月联邦基金利率达到35.20美元/盎司之前,金价触底一年左右。在尼克松于1970年8月关闭金窗后,黄金价格达到195.5美元/盎司。联邦基金利率在1974年7月提前五个月达到峰值,达到12.92%。许多投资者利用尼克松关闭黄金窗口(1970年8月)之后的时期,更多的是真正的市场黄金价格。这是因为现在允许自由市场力量决定美元和黄金相互之间的价值。在接下来的20个月里,黄金价格从1974年12月的高点回落,跌至100美元/盎司的低点。1976年8月。

Interest Rates after the Nixon Shock

尼克松冲击后的利率

After peaking out in August 1971, the fed funds rates bottomed at 3.29%, then moved up to 12.72% in July 1974. Just like when rates were rising on the way up, there were pauses on the way down, briefly going up before bottoming out. After the peak in 1974, rates finally bottomed in January 1977 at 4.61%. There were pauses on the way up for both gold and interest rates. As the old saying goes, “Nothing goes straight Up”. In the first half of the 1970’s, neither one led one another all of the time. They at times switched which one led when peaking and when bottoming. They also did not conclusively show that if one was rising, the other would always be falling.

在1971年8月达成峰值后,联邦基金利率触底反弹至3.29%,然后在1974年7月上升至12.72%。就像上涨时的利率上升一样,下跌时间暂停,在触底前暂时上涨出。在1974年的高峰期之后,利率最终在1977年1月触底4.61%。黄金和利率都在上涨之中。正如那句老话:“没有什么可以直接上升”。在二十世纪七十年代的上半叶,两个人都没有一直互相领导。它们有时会在峰值和触底时切换哪一个。他们也没有最终表明,如果一个人在崛起,另一个人总会在下降。

The Second Half of the 1970’s

1970年代后半期

The second period of the 1970’s, investors saw a meteoric rise in interest rates from a low of 4.61% in January 1977, to 19.1% in June 1981. Gold went from $100/oz. in December 1976 to $910.60/oz. in January 1980, increasing by more than 50% increase in the final phase transition up. Gold started its rises a few months prior to interest rates moving up and peaked out a few months before. In this instance, from a multi-year trend perspective, gold and interest moved in the same direction with one another. Interest rates made an initial bottom to 8.63% in May 1983. Whereas gold, bottomed out almost 14 months prior, at $312.50/oz. On a multi-year trend basis, gold and the fed funds rate approximately moved together. During the 1970’s, the relationship between gold and interest rates can be better viewed on a decade basis to get a clearer picture because you can see their behavior throughout the business cycles

在1970年代的第二个时期,投资者看到利率从1977年1月的4.61%的低点急剧上升到1981年6月的19.1%。黄金从100美元/盎司上涨。1976年12月至910.60美元/盎司。1980年1月,最后阶段过渡增加了50%以上。黄金在利率上升前几个月开始上涨,并在几个月前达到顶峰。在这种情况下,从多年趋势的角度来看,黄金和利息彼此向相同方向移动。利率在1983年5月初步触底至8.63%。而黄金在14个月前触底反弹至312.50美元/盎司。在多年趋势的基础上,黄金和联邦基金利率大致一起移动。在二十世纪七十年代,黄金和利率之间的关系可以在十年的基础上更好地查看,以获得更清晰的图景,因为你可以看到他们在整个商业周期中的行为

How Did Gold and the Fed Funds Rates Perform in the 80’s and 90’s?

80年代和90年代黄金和联邦基金的利率如何表现?

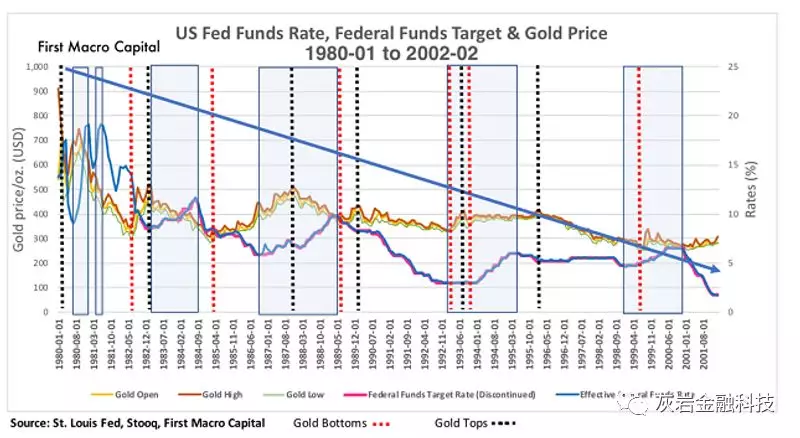

After former Fed Chairman, Paul Volcker stepped in and tamed inflation with the ratcheting up of interest rates, the U.S. experienced a deep recession thereafter. Gold plummeted to $312.51/Oz in March 1982, as rates came back down bottoming out in March 1983. If one was to look at the entire 20-year trend, the fed funds rate would be down, and gold would be the same. It would appear that the relationship can be best viewed over long-term time periods just like in the 1970’s. Shorter-term time periods during the 1980’s and 1990’s did not provide conclusive results between the fed funds rates and gold.

继前美联储主席保罗沃尔克介入并遏制通货膨胀加剧利率后,美国此后经历了深度衰退。随着利率在1983年3月触底反弹,金价在1982年3月暴跌至312.51美元/盎司。如果要考虑整个20年的趋势,联邦基金利率将下降,黄金将是相同的。看起来这种关系可以在长期的时间段内得到最好的观察,就像在1970年代那样。1980年代和1990年代的短期时间段没有提供联邦基金利率和黄金之间的结论性结果。

What Happened to Gold and Fed Fund Rate in the 2000’s?

2000年的黄金和联邦基金利率发生了什么变化?

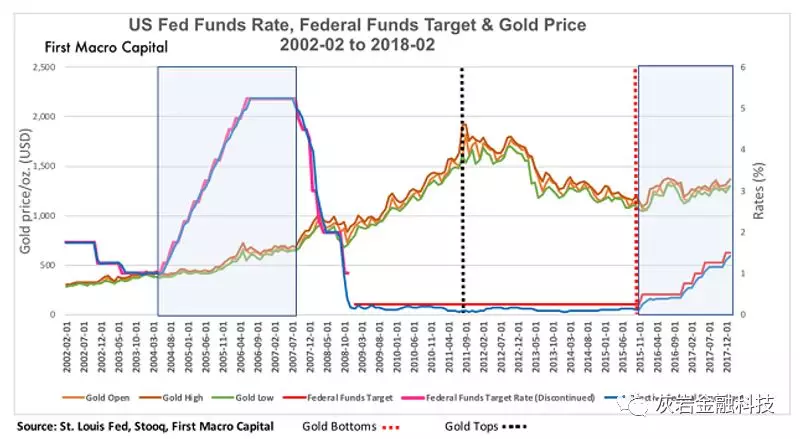

After the tech boom in the United States, the Federal Reserve dropped its target to 1% in June 2003, with the fed funds rate hitting a low of 0.98%. Gold bottomed in June 1999 at $251.95/oz., almost four years before interest rates bottomed. All commodities boomed as demand from the emerging markets grew rapidly led by China. The US dollar index went from being above 120 in 2001, falling to just above 70 in early2008. A 42% drop! When you combine the increasing commodity demand from China and the fall in the US dollar. These set the gold price on a higher trajectory, just like the entire commodity complex during this time. Gold did not break its bullish trend, until seven months after the Fed started lowering rates. By this time the Fed’s target was already cut in half to 2.25%. But the gold trend broke away from the low rates, after making a brief bottom in October 2008 at $621.45/oz., continuing its upward trend. After the banks were bailed out, investors began to see the issues were not just on the private asset side, but on the public side too.

在美国科技繁荣之后,美联储在2003年6月将其目标下调至1%,联邦基金利率达到了0.98%的低点。金价在1999年6月触底,报251.95美元/盎司,差不多在利率触底前四年。所有商品都蓬勃发展,因为新兴市场的需求在中国的带动下迅速增长。美元指数从2001年的120以上升至2008年初的70以上。下降42%!当你结合中国日益增长的商品需求和美元贬值时。这些将金价设定在更高的轨道上,就像在此期间的整个商品综合体一样。在美联储开始降息之后七个月,黄金并没有打破其看涨趋势。到目前为止,美联储的目标已经减半,降至2.25%。但在2008年10月短暂触底621.45美元/盎司后,黄金走势脱离了低位,延续了上涨趋势。在银行获得纾困后,投资者开始认为这些问题不仅存在于私人资产方面,而且也存在于公众方面。

What Happened Since 2010’s

自2010年以来发生了什么

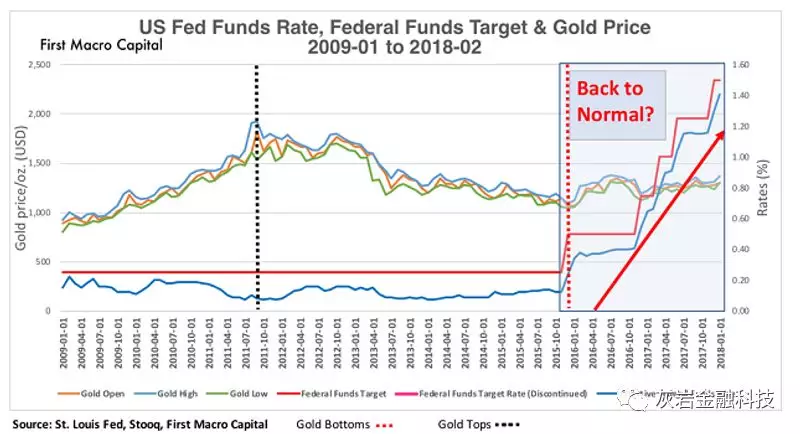

After 2008, the fed funds target rate stayed flat for six years at 0.25%. But the fed funds rate remained below the target the entire time. Unlike in the 2000’s where the moment the Fed dropped its target to 1%, the fed funds rate was already at or back above the target. On a monthly basis, the fed funds rate only fell below the 1% fed target once, to 0.98% over the 12-month period the target was at 1% in the early 2000’s.

2008年以后,联邦基金目标利率连续六年保持在0.25%不变。但联邦基金利率始终低于目标。与2000年美联储将其目标下调至1%的时刻不同,联邦基金利率已经达到或高于目标水平。按月计算,联邦基金利率仅下降至1%美联储目标之下,在12个月内达到0.98%,目标在2000年初达到1%。

The Big Disconnect

巨大的脱钩

After 2008, gold and rates did not follow in lock-step with one another. We saw a major issue with a confidence in the U.S. Federal Government, and the European debt crisis. It was the confidence in the public sector, that drove assets out of public assets and into private assets, like gold and other commodities, not from rising rates.

2008年之后,黄金和利率并没有相互锁定。我们看到了一个对美国联邦政府和欧洲债务危机充满信心的重大问题。这是对公共部门的信心,它将资产从公共资产和黄金和其他商品等私人资产中驱逐出去,而不是来自利率上升。

The Commodity Complex

商品综合体

The commodity complex appears to have bottomed for many commodities, not just for gold, but for oil, uranium, and many of the base metals. The Fed has spoken about further rate hikes, and with the recent tariff talk, and the US dollar index topped out in December 2017, which will increase the volatility in the markets. In March 2002, the U.S. imposed 30% global steel imports. Interest rates went lower until 2004, and gold went higher. This rising gold may highlight an issue of confidence in the public assets and not of a relation to the interest rates in this instance. Commodities appear to be rising from the ashes, with a currently strong global economy reflected in the PMI’s, a declining US dollar since the end of 2017, increasing tariff risk, and it sets things up for higher commodity prices, over the next few years.

商品综合体似乎已经触底了很多商品,不仅仅是黄金,还包括石油,铀和许多基本金属。美联储已经谈及进一步加息,以及最近的关税谈判,以及美元指数在2017年12月达到顶峰,这将增加市场的波动性。2002年3月,美国对全球钢铁进口征收30%的进口。利率在2004年之前走低,黄金走高。这种上涨的黄金可能会凸显出对公共资产的信心问题,而不是与这种情况下的利率关系。大宗商品似乎从灰烬中崛起,目前强劲的全球经济反映在PMI,自2017年底以来美元贬值,关税风险增加,并在未来几年内为商品价格上涨做好准备。

More Rate Hike Coming – Good for Gold?

更多加息来临 - 对黄金有利吗?

On a monthly or yearly basis, it is difficult to conclude that the fed funds rate leads to gold, or gold leads the fed funds rate. What maybe be more helpful is to look at gold and interest rates over 5-10 years, even a 20-year period. The business cycle, which can range between 5-10 years, goes hand and hand with the rise and fall of the fed funds rate to complete its cycle. Commodity booms typically at least 4 years, and the bust is at least 2-3 years. We would consider setting the minimum time period to compare both gold and interest rates at least over a 7-8-year period, to compare their behavior to one another. Over the next 5-10 years, it is more likely that we will see higher commodity prices as the bond bubble bursts, the debts are reignited from rising rates, which will push capital flowing into private assets like commodities, not just gold. In the near-term over 1-2 years, history is not conclusive enough to give any solid evidence as to the relationship between the fed funds rate and gold.

在每月或每年的基础上,很难得出联邦基金利率导致黄金或黄金导致联邦基金利率的结论。可能更有帮助的是看5到10年甚至20年的黄金和利率。商业周期可以在5到10年之间,与联邦基金利率的上升和下降密切相关,以完成其周期。商品繁荣时期通常至少为4年,而破产至少需要2 - 3年。我们会考虑设定最短时间段来比较黄金和利率至少在7 - 8年期间,以比较他们的行为。在未来5到10年内,随着债券泡沫破灭,我们更有可能看到更高的商品价格,债务再次从利率上升中重新点燃,这将推动资本流入商品等私人资产,而不仅仅是黄金。在短短1 - 2年的时间里,历史不足以为联邦基金利率与黄金之间的关系提供任何可靠的证据。

Take Away for the Portfolio Manager and Gold Stock Analyst

来自投资组合经理和黄金股票分析师的干货

- Predicting the outcome of interest rates and gold in relation to one another on a monthly basis can be a difficult task. Over the past 40 years, the data shows that gold can lead interest rates, or interest rates can lead gold. They can even go in the opposite direction for extended periods.

- 每月预测利率和黄金相互之间的结果可能是一项艰巨的任务。在过去40年中,数据显示黄金可以引领利率,或者利率可以引领黄金。他们甚至可以长时间向相反的方向前进。

- Stick to areas of the value chain within the gold sector that you have an advantage over others.

- 坚持黄金领域的价值链领域,你比其他领域更具优势。

- Companies growing the production profile on a year-over-year basis above industry peers have an opportunity to create shareholder value.与同行相比逐年增加产量的公司有机会创造股东价值。

- Follow the commodity complex. Commodity cycles, which considers all commodities together, are more predictable over long-term time periods to gold than interest rates.

- 跟随商品综合体。商品周期将所有商品放在一起考虑,在长期黄金期间比利率更可预测。

未经允许不得转载:tiger trade » 黄金系列专题 ——利率和金价的联系

tiger trade

tiger trade